Employee Expense

Expense720 introduces a new document type, "Employee Expense", enabling efficient handling of employee-submitted expenses. This feature supports seamless submission, approval, and posting processes for employee expenses.

Features

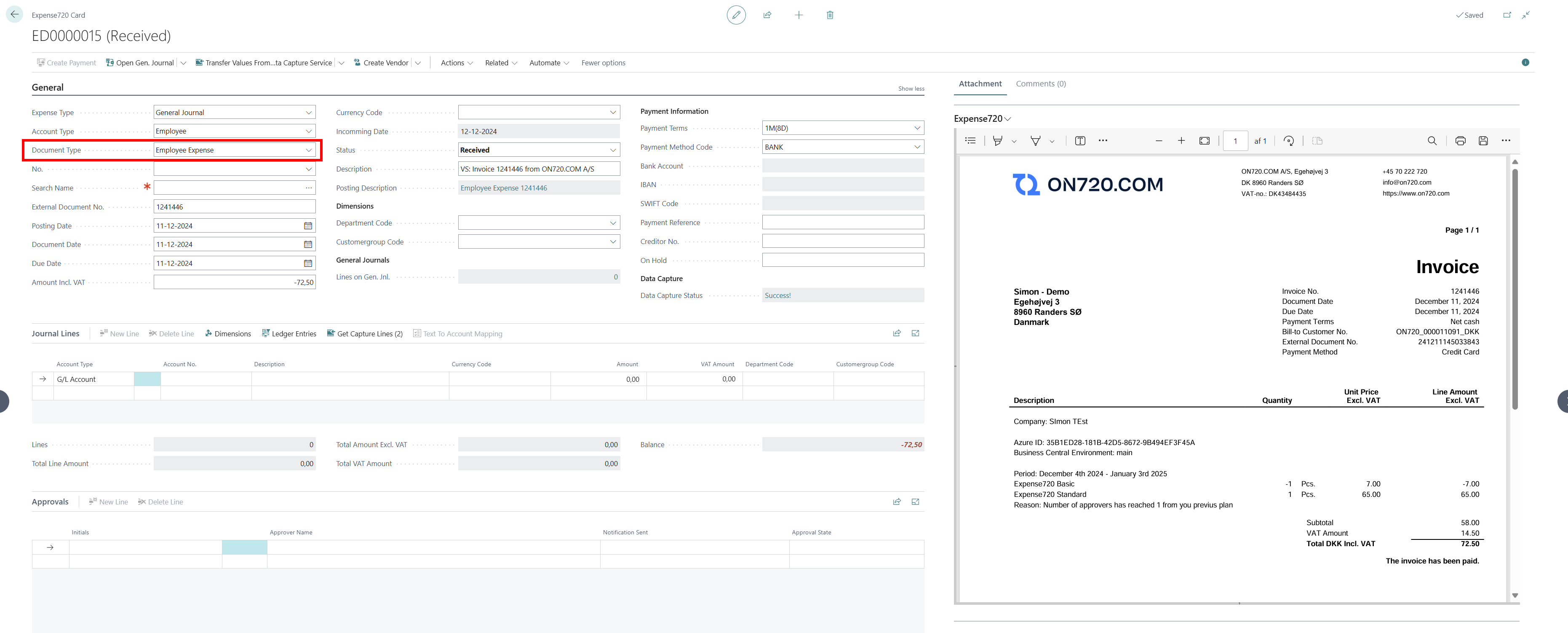

Document Type: Employee Expense

- Selection in Expense

- The new Document Type, "Employee Expense," is available for selection in Expense entries.

- Default Setup

- In Expense Setup, administrators can define "Employee Expense" as the default Document Type for relevant entries.

- Enhanced Expense Table and Card Page

- A new field, Account Type, is added to support the "General Journal" Expense Type.

Mobile App Integration

- When receipts are uploaded through the Business Central Mobile App, the system defaults the Document Type to "Employee Expense."

- The Expense Type, Account Type, and Account No fields are automatically populated based on the approver associated with the user uploading the document.

Approver Settings for Employee Expense

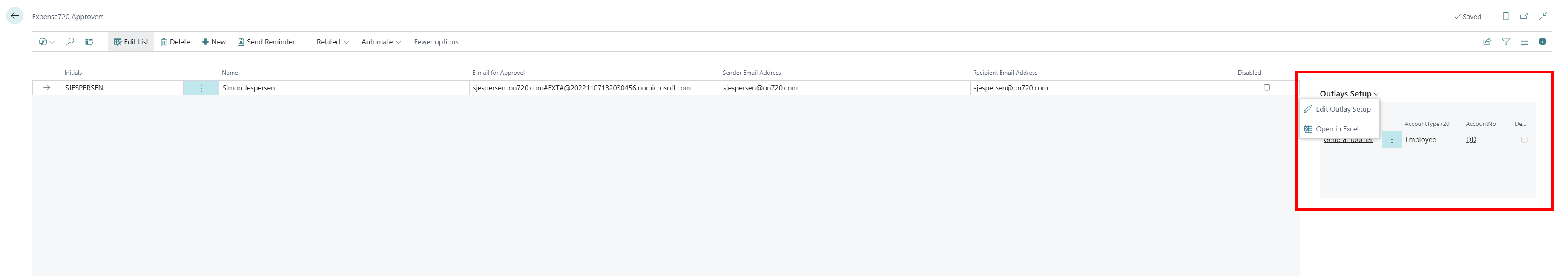

- Expense Approvers List

- A new fact box in the Expense720 Approvers list allows configuration of Employee Expense settings.

- Flexible Configuration

- Approvers can define multiple configurations for Expense Type, Account Type, and Account No, which are saved in a dedicated table.

- Default Configuration

- A default setup applies for mobile app uploads, simplifying initial processing.

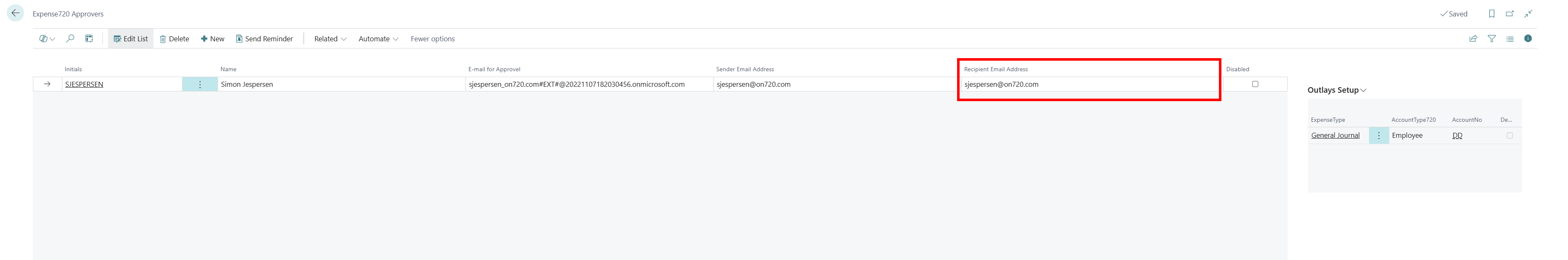

Email Integration

- The system can restrict Employee Expense handling to specific mailboxes.

- Submitter identification is based on the sender’s email, ensuring accurate processing.

- A new field under Expense720 Approvers allows specification of the sender's email for better tracking.

Usage Workflow

- Receipt Upload

- Via Mobile App: Employees can upload receipts directly through the Business Central Mobile App. Since the employee is logged into the app, the system automatically knows who the expense belongs to. The Document Type is set to "Employee Expense", and the relevant configuration (Expense Type, Account Type, and Account No) is applied based on the logged-in employee’s approver settings.

- Via Email: Alternatively, employees can submit receipts via email to a configured mailbox. The system identifies the sender based on their email address and applies the correct configuration if it is defined.

- Configuration Application

- The system automatically applies the configured Expense Type, Account Type, and Account No based on the approver’s setup or the default configuration.

- Expense Processing

- Employee expenses can be posted as:

- Employee Ledger Entries through a general journal.

- Vendor Ledger Entries through a purchase invoice.

- Employee expenses can be posted as:

- Submitter Identification

- When uploaded via the app, the system identifies the employee based on their login credentials. For email submissions, the sender’s email address is used to determine the submitter and apply the appropriate configuration.